Investing in the world's fastest growing economy

This small country's discovery of gigantic oil reserves has unlocked new opportunities for the adventurous investor.

ExxonMobil’s discovery of nearly 11 billion barrels of oil in the deep waters of Guyana has changed the country forever, from being largely under the radar to being the fastest-growing economy in the world. This staggering growth is hard to ignore. But are there opportunities for retail investors like us?

Guyana has largely embraced oil development, signing deals with Exxon, CNOOC, and Hess Corporation. With oil accounting for 88% of its exports, the country has joined the very inclusive club of petrostates. While abundant natural resources can lead to the so-called “resource curse” (nations with great natural resource wealth experiencing lower economic growth than countries without), Guyana seems to manage well with 43% GDP growth in 2024.

The history of petrostates is not as modern as it used to be. This allows Guyana to learn from the past failures, from the countries that won the lottery but went back to being broke some years later. The list of those is long: Algeria, Nigeria, Libya, Iraq, and, of course, Guyana’s neighbour, Venezuela. Sure, some of these countries had unfortunate circumstances and/or received a forceful dose of democracy from Uncle Sam. In this regard, Guyana’s prospects appear more promising. The government isn’t trying to trip the US up. In fact, Exxon, a flagship American corporation, is making ridiculous money from its operations in the country. Additionally, Guyana is a relatively stable English-speaking democracy.

For investors, participating in the early boom of an entire nation can be very exciting. Yet, in the case of Guyana, direct investment opportunities for retail investors are limited, with only 12 stocks actively trading on the country’s national stock exchange. Their foreign and early-stage nature also makes them inherently riskier plays. We strongly recommend that anyone considering this path take the time to understand the economic and political forces at play in Guyana.

An oil success story

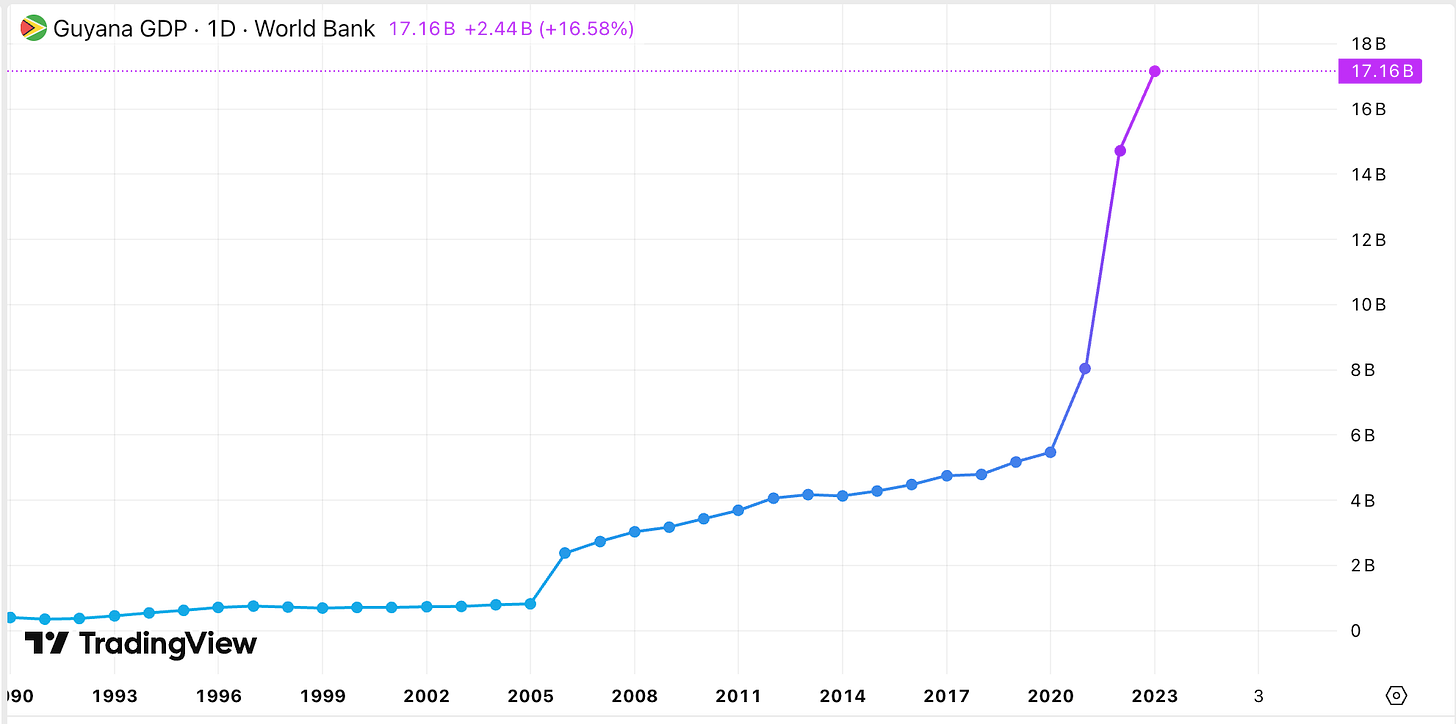

Guyana’s economy was relatively unremarkable before the massive offshore oil discoveries in its territorial waters in 2015. Since then, its economy has more than tripled.

According to the International Monetary Fund (IMF), between 2022 and 2024, Guyana’s real GDP grew at an average annual rate of about 47%, making it the fastest-growing economy in the world. Its GDP per capita also saw a significant gap-up, from US$6,477 in 2019 to US$30,962.25 in 2023. That makes the country the richest in South America by GDP per capita.

Oil is the main driver behind the economic miracle. The production rapidly increased since the discovery of 2019, and Guyana has benefited from growing oil prices post-covid. Production reached an average of about 645,000 barrels per day (bpd) in late 2024. To put it in context, that makes Guyana the 28th largest oil producer in the world, far behind the OPEC giants. So why is Guyana doing so well when it produces less oil than countries like Colombia or Egypt?

One key factor is Guyana’s small population of just 826,353 (2023 census), which is less than the urban population of Tucson, Arizona. This smaller population simply means the oil wealth has fewer mouths to feed and can be leveraged more effectively. Other successful small petrostates like Kuwait, Qatar, and Norway have previously shown how smaller populations can maximize resource wealth.

However, population size is not the only factor. Guyana has also done an excellent job allowing ExxonMobil to focus on what it does best. The government has established a transparent and efficient policy framework without excessive red tape. Unlike many oil-producing countries that nationalize assets or create state-owned enterprises (SOEs) with complex joint venture rules, Guyana has allowed ExxonMobil and its partners (Hess Corporation and China National Offshore Oil Corporation) to retain full ownership and operational control of their oil projects. Many countries in Africa and Latin America have nationalized oil assets or imposed government participation that often slows project development and introduces inefficiencies such as corruption and bureaucracy. The struggles of Pemex (Mexico), PetroSA (South Africa), and Sonangol (Angola) have provided a strong case for privatization in the oil sector.

While ExxonMobil and its partners have full ownership stakes in the oil projects, the Guyana government has kept ownership of the oil reserves. It also maintains some control by approving and overseeing projects. For example, it approved ExxonMobil’s Whiptail Project in 2024 with strict conditions, intending to balance foreign investment and safeguard national interests. This balance has, however, been subject to criticism from external actors. The 2% royalty rate for the Exxon-led consortium was among the lowest in Latin America, and Guyana has been urged to get a better deal. Which they did when the government hiked the royalty rate to 10% in 2022 and then introduced a 10% corporate tax in 2025. However, these changes do not apply retroactively to the original Stabroek Block contract with ExxonMobil, which still benefits from the lower rates.

Resource curse?

Guyana’s story has drawn significant attention from newspapers and social network commentators, many of them fearing that the country would be another victim of the resource curse.

We briefly defined the resource curse in the introduction, but to go more into detail, it is a paradox in which countries rich in natural resources (particularly oil, gas, and minerals) often encounter unique socioeconomic challenges such as slowed economic growth and violent conflicts. Subsequently, these countries become worse off than countries without abundant natural resources.

It’s interesting that many journalists were quick to raise such concerns for Guyana, given that the resource curse remains a theory whose validity is still very in question. The relationship between natural resources and GDP growth has been studied extensively by many scholars and economists, with conflicting conclusions1. Moreover, the world has seen countries like Qatar, Malaysia and Botswana successfully leverage their resource dependence to build wealthy and stable nations.

One possibility is that the “curse” is actually a reflection of poor economic performance and political framework that preceded resource dependence. The weak institutions and bad policies in place would cause mismanagement of the resources, rather than resources causing those problems. If this is true, Guyana would be in a better position than countries often cited by the curse advocates, such as Angola and Venezuela, both of which were under military rule during their oil discoveries. Scoring 6.05 in 2010 and 6.12 in 2020 on the Economist Democracy Index (where 9 is the highest score), Guyana is classified as a flawed democracy. While it faces challenges, the country and its politics are functional overall.

It is arduous to predict the fate of Guyana with so many factors at play. Nonetheless, the current developments are promising. In 2025, Guyana’s flagship upstream development, the offshore Stabroek block, is due to increase production by 40% to 870,000b/d. Meanwhile, the government is using the oil wealth to fund broad infrastructure projects and social programs. With the medium/long-term goal of economic diversification, the government is actively promoting investments in other industries such as agriculture and mining. The non-oil economy recorded 12.6% growth in the first half of 2024, up from 11.7% the previous year2, signalling more of a positive spillover effect from the oil sector rather than evidence of a resource curse so far.

Upcoming election and Venezuelan threat

Guyana will hold general elections in September 2025, and it is expected that President Irfaan Ali will be reelected for a new five-year term after a contentious vote in 2020. Ali’s People’s Progressive Party/Civic (PPP/C) may gain a more decisive majority in parliament from the current 33 out of 65 seats. It’s important to understand that the main contenders, the PPP/C and the APNU/AFC coalition, represent more than just political parties. They embody the two largest ethnic groups in Guyana competing for political power: the Indo-Guyanese largely support the PPP/C, while the Afro-Guyanese predominantly back the APNU/AFC.

The existing polarization within Guyanese society is intensified by the high stakes involved: the eadership of a petrostate in the making and the opportunity to shape the country’s transformation. As such, the upcoming elections will serve as a crucial test of Guyana’s political stability. Investors may prefer to await the outcome of the election to mitigate the risk of potential turbulence.

Internal risks are also accompanied by external ones as tensions with the neighboring country Venezuela have been intensifying since the oil discovery. Venezuela has long claimed the Essequibo territory, which covers about two-thirds of Guyana’s land but only 15% of its population. While Venezuela’s territorial claims were less aggressive during Hugo Chávez’s rule, the successful oil drilling in the Stabroek Block, located offshore the Essequibo region, has surprisingly reignited Venezuelan territorial ambitions.

Recently, the following diplomatic incidents occurred:

In March 2024, Venezuela passed a law that designated Essequibo as a new state of Venezuela,

In March 2025, a Venezuelan naval patrol vessel entered Guyanese waters near an offshore oil block of ExxonMobil,

In May 2025, Venezuela decided to elect officials to administer the territory of Essequibo.

It’s clear the situation isn’t improving.

The good news is that international law is on Guyana’s side and perhaps more importantly, Guyana enjoys more sympathy from the international community than the hostile state of Venezuela. The United Kingdom and the United States have voiced their backing for Guyana in its geopolitical quarrel. It is also a massive advantage of having a US company operating on the territory at risk. The White House would likely be upset to see the interests of ExxonMobil compromised, especially amid the current global energy security challenges.

Despite the international support for Guyana, the threat of an escalation of the conflict is very real and we urge investors to factor it as part of their investment thesis.

Conclusion: bullish outlook, risk-adverse investors stay out

Guyana was dealt a good hand with ExxonMobil’s discovery of massive oil reserves in its territorial waters. However, this would amount to nothing without the right strategic decisions on how to leverage these resources. So far, these decisions have proven to be successful and Guyana is on its path to build a wealthy petro-state in the South American jungle, provided internal and external tensions do not esclate further.

Large amounts of money can be made during such exciting times for adventurous investors. Infrastructure, industries and services can all benefits from the spillover effect of oil revenues. With limited offer on the local stock exchange and few foreign companies operating in the country, one challenge for investors will be to find ways to get exposure to opportunities.

Thank you for reading. And feel free to subscribe, it’s free:)

https://www.brookings.edu/articles/are-natural-resources-a-curse-a-blessing-or-a-double-edged-sword/

https://nearshoreamericas.com/guyanas-gov-aims-for-economic-diversification-and-42-gdp-growth-in-2024/