Deconstructing housing

Real estate is known as a fortune maker, but what if it actually makes you poorer?

If you are young and have enough cash saved for a down payment, you are probably thinking about getting into real estate. You don’t want to miss another train, right?

Whether for investment purposes or to live in a property that belongs to you, it’s common advice nowadays to take out a loan and buy as soon as you’ve saved enough for a down payment. Decades of rising housing prices have framed purchasing real estate as one of the most sound financial decisions. Curiously, this is rarely disputed.

We can’t accurately predict the prices of housing 10 or 20 years from now; everyone who has tried to has failed. But based on past and current data, we can argue that first, real estate returns aren’t as impressive as many believe; and second, market conditions are poised to change drastically in the coming years. And this might give you second thoughts about purchasing a property.

Note: this article isn’t about doing the maths of owning vs renting. There are already numerous resources about that, and it is geographically specific. Its purpose is instead to assess real estate as a financial instrument. Though you will see that our argument inevitably makes a case for renting.

The truth about real estate’s returns

The premise of this article is that real estate (RE) is overhyped from a financial point of view. Historically, RE is greatly appreciated for the leverage it allows, the returns it has provided, and the fact that it is a physical investment. For many, it’s easier to understand than an abstract list of tickers.

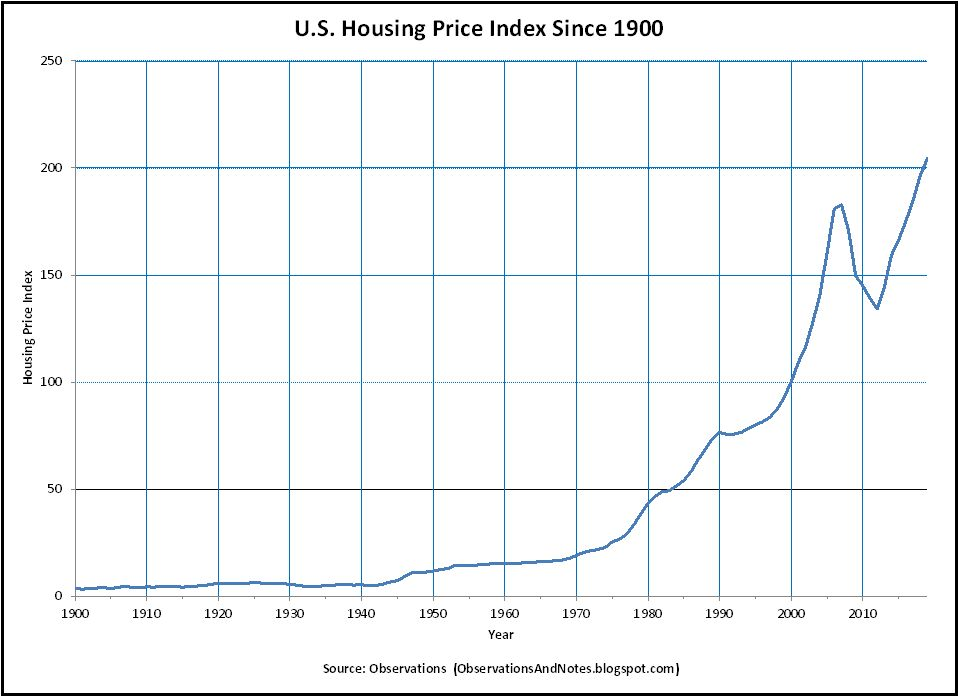

In more recent times, housing prices experienced tremendous growth, which has skewed the perception of investors. Many people have in mind the 20%/30% (or more) jumps we saw during Covid. Or the longstanding growth of the 2000s. Looking at the chart of median sale prices of homes for the US since 1900, one can immediately notice the curve going parabolic from the late 90s:

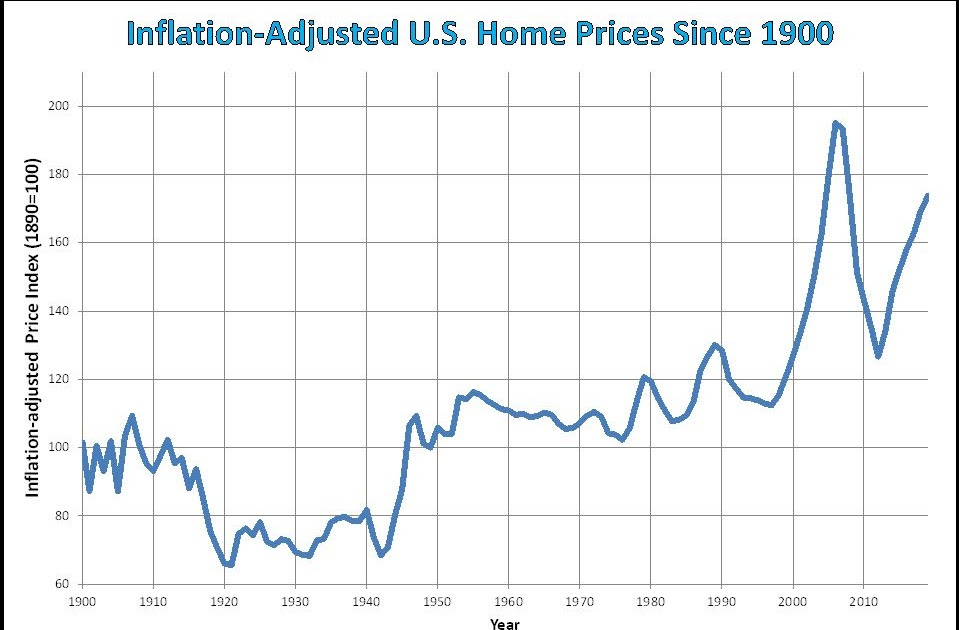

However, this chart omits various factors. The elephant in the room is the loss of purchasing power that the Dollar has experienced during this period, i.e., inflation. If we use the Fed’s preferred measure of inflation, the CPI, and adjust the housing price index against it, we get the following chart:

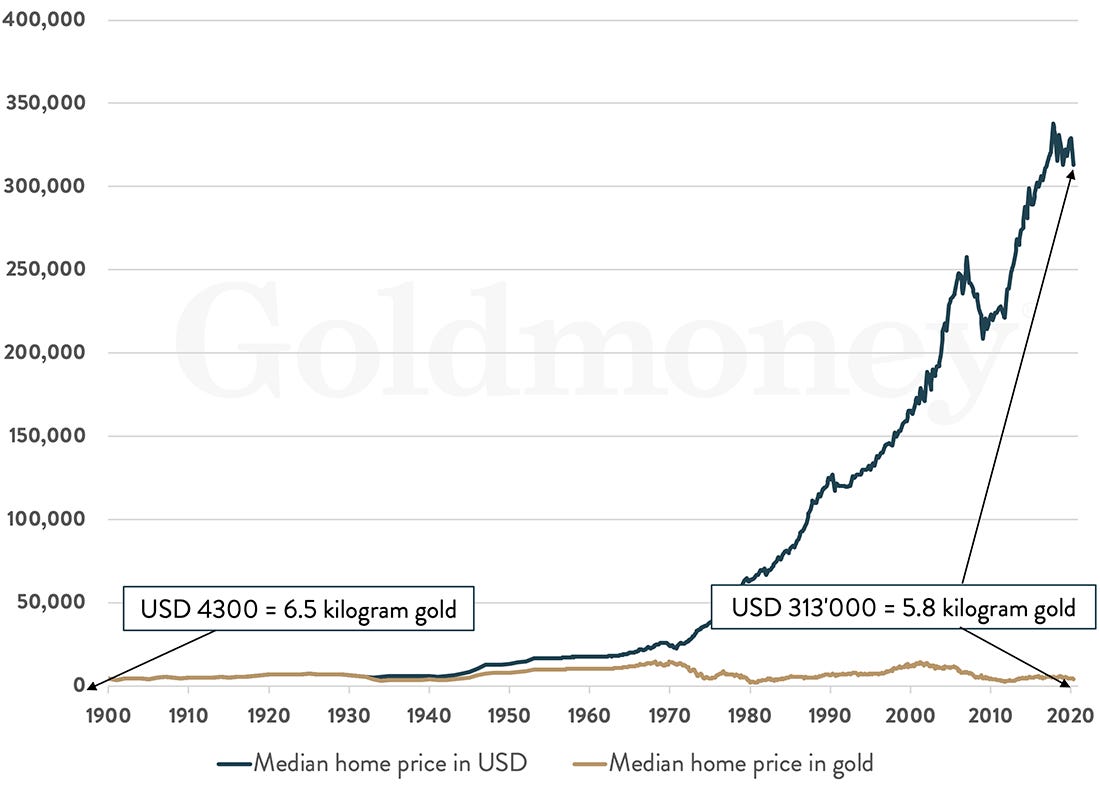

The returns already look less impressive here. It gets worse when we consider how real estate prices have evolved when measured in gold:

Flat.

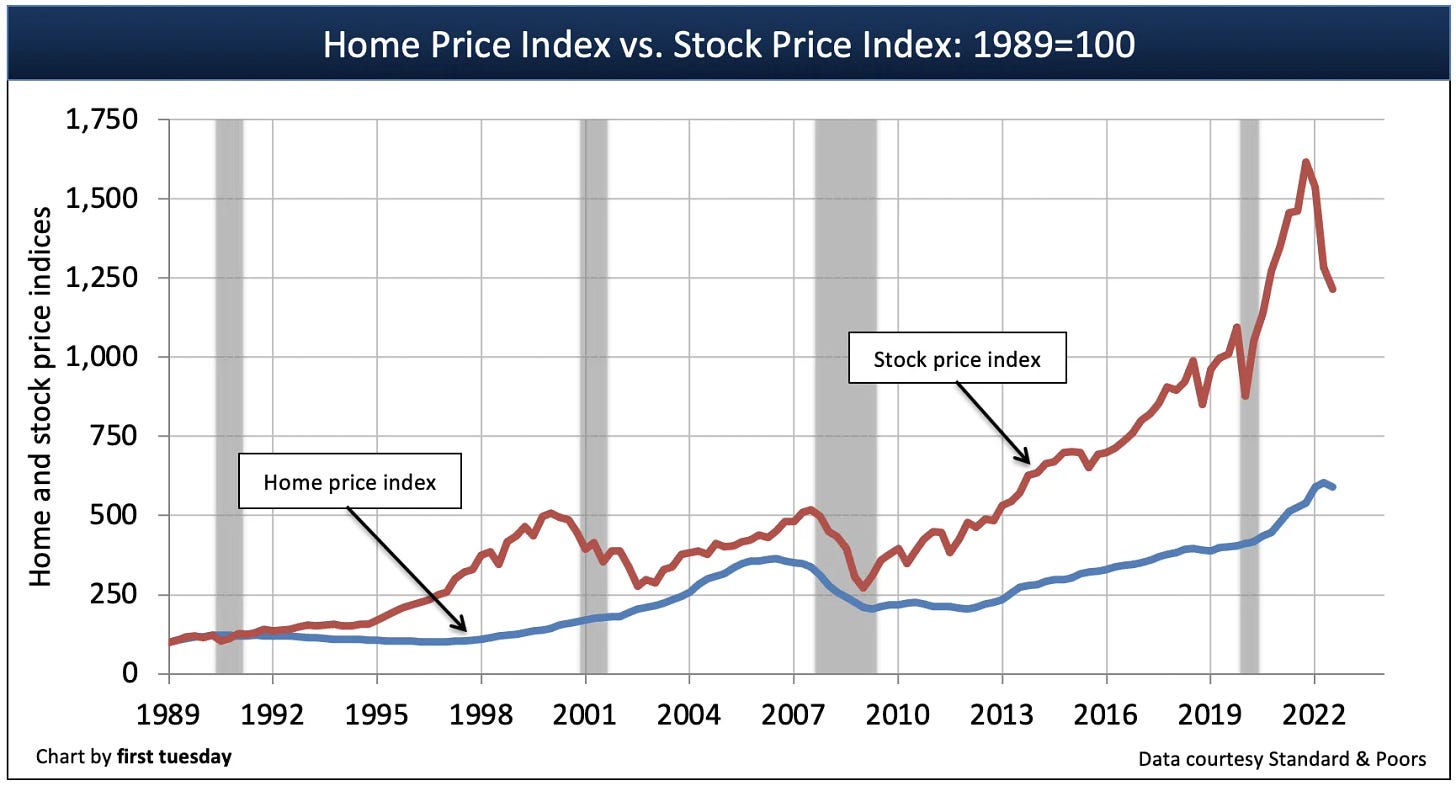

Or to stocks:

On top of that, homeowners have to bear with additional ongoing expenses, which are far too often omitted from the real estate’s returns conversation:

property taxes (typically 1% to 2% of value annually)

Maintenance (1% of property value yearly)

insurance

property management fees (usually 8% to 12% of rental income).

By comparison, many stock index funds only charge annual fees of 0.03% to 0.15%. There are plenty of vault services that charge less than 1% annually for gold storage, too.

Turbulences ahead

We identify several factors that suggest a slowdown in the hike of real estate prices in the future. And with rampant inflation, this would further make real estate less competitive compared to other financial investments. Here’s our case:

💨 Strong demographic headwinds

Fertility rates well below replacement level and rapidly aging populations are the most obvious threats to the housing market. We discussed this problem in our recent post about gold for retirement, and its impact on housing could be as big as on retirement pensions. Japan is somewhat front-running the demographic issues that we’ll soon experience in the West. The country is experiencing a rapidly aging and shrinking population. It was reported to have lost 898,000 people in 2024.

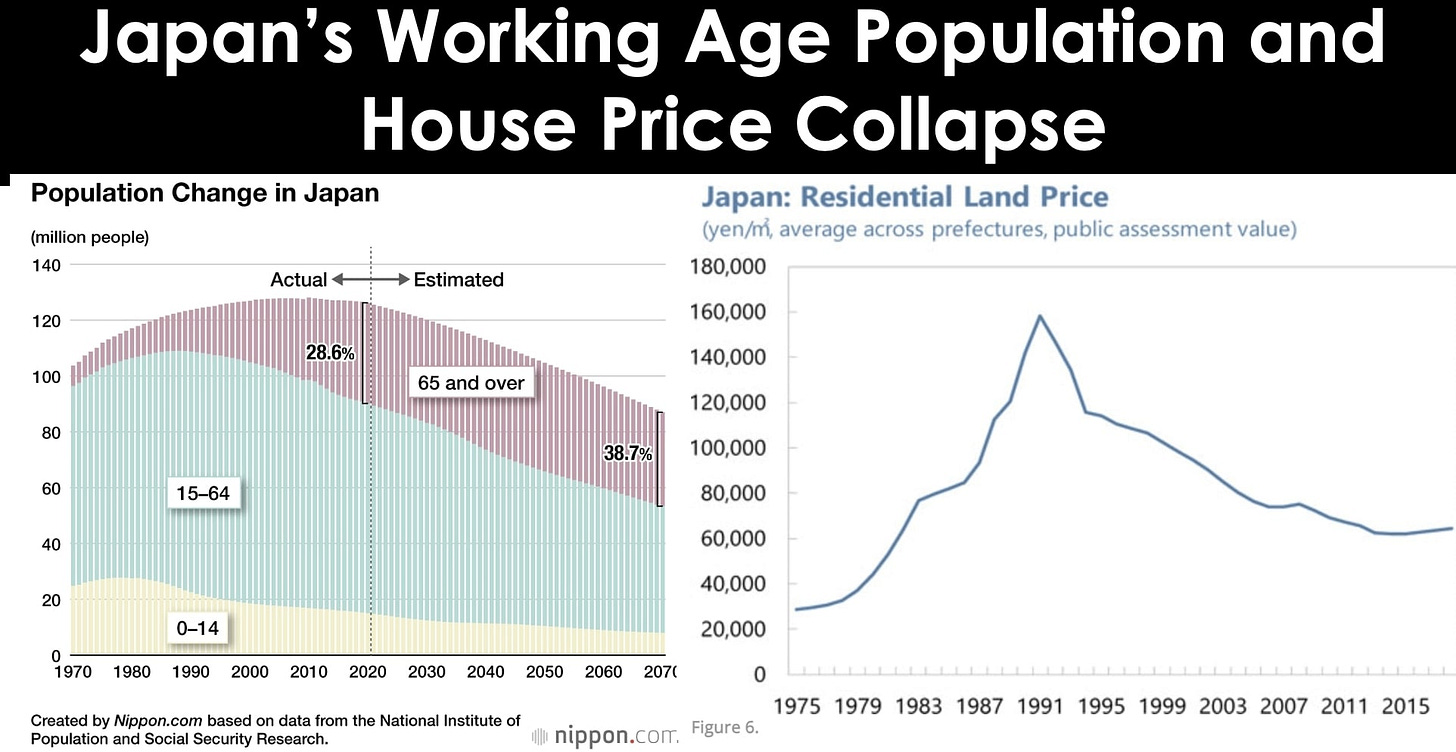

It is interesting to compare charts of population age distribution changes and housing prices side by side. While housing prices are influenced by many factors, one cannot help but notice that these charts follow similar trends:

The logic behind this is not difficult to understand: fewer people free up housing stock, which drives demand and prices down.

However, more recent data shows that Japan has reversed this trend, with housing prices rising and nearing levels seen in the 1990s (unadjusted for inflation). This suggests that demographic effects can be suppressed by larger forces. In Japan’s case, growth has been driven by the largest cities, where land prices are considerably higher. Younger Japanese flocking to the country’s largest cities and increased foreign buyers have kept the housing markets of Tokyo, Osaka and Nagoya competitive:

The price appreciation in these largest cities has, however, come at the expense of secondary cities and rural areas, where no significant price recovery has occurred. Thus, the “revival” of the housing market paints a flawed picture, as growth in the most expensive housing stock masks the poor performance in much of the rest of the country.

💨 Higher interest rates are to come and to stay

The era of low rates has likely ended for the foreseeable future. Since real estate is typically bought with a loan, prices are highly sensitive to interest rates. When money is cheaper (lower rates), housing prices go up. When money gets more expensive (higher rates), prices have to adjust down, as people can’t easily take on very large loans. This is visualized in the following chart.

It is our belief that what seems like a “forever up” loop in housing prices is largely caused by artificially low interest rates that have gone down continuously since the 80s. Contrary to retail (and Trump’s) sentiment pushing for lower rates, our view is that there is currently no reason to cut. Markets are at all-time highs, with the largest US firms earning more money than ever. Pre-revenue AI startups are raising billions very easily. SPAC season is starting again. Gold, which pays no interest, is at an all-time high. Sure, there are data points suggesting cracks in the labor market, tech firms are doing layoffs, and oil prices are soft. We are likely in a stagflation. However, the FED has no tools against stagflation, and it has also lost control of the bond market. With the US credit rating decreasing due to its gigantic pile of debt, yields will go up, rather than down. Debtors want more money in return for buying US debt, and the US will face more competition in the debt market. More on this here:

💨 Inheritance money won’t be enough to sustain current prices

Recently, The Guardian and other major newspapers claimed that the millennial generation is “on course to become the richest generation in history.” Yet, most millennials remain completely priced out of the housing market. This strong disparity reveals that inheritance money is not a straightforward net transfer of wealth between generations.

Inflation is eating away at the purchasing power; the nominal amount inherited buys less over time. As much of the wealth held by baby boomers is tied up in low-return or depreciating assets like real estate, cars, and savings accounts, it is particularly vulnerable to currency devaluation.

Inheritance is also subject to taxation in most jurisdictions. In the US, the real estate tax rate for 2025 is 40% for a taxable estate value above $1,000,000. The implication is that a good share of baby boomers’ wealth is captured by the government and then inefficiently redistributed back to society.

As younger generations lack sufficient wealth to buy into the housing market, the value of inheritance becomes critical to sustaining housing prices. If inheritance money falls short of bridging the gap between what buyers can afford and sellers’ asking prices, we foresee a scenario where homeowners could be forced to lower their prices significantly.

Adding to this pressure, governments across the West are facing worrying levels of national debt, making property owners an easy target for new taxes. Municipal taxes and property levies are already increasing; for example, Toronto homeowners face a 6.9% property tax hike in 2025. Even those fortunate enough to inherit high-value properties may lack the liquidity to cover rising municipal taxes and strata fees, forcing them to sell and further depressing the market.

💨 Baby boomers will be forced to sell

As a final point and personal theory, we believe that technological advances and increasing life expectancy will reshape the housing market through rising senior care costs. As medical science progresses, people are living longer, which means many will spend more years in retirement homes or assisted living facilities. Those are becoming extremely costly, on average $9,733 for a private room in a nursing home in the US!1. The senior healthcare sector has been one of the most impacted by inflation because of industry dynamics such as labor shortages and rising insurance rates. At the same time, the industry cannot cope with rapidly growing demand, and providers are forced to ration care through pricing, making it even less affordable:

How does this relate to housing? We predict that many seniors will be forced to sell their homes (or mortgage them) to cover these escalating healthcare and retirement costs rather than passing their estates intact to heirs. Again, if new generations are priced out of the market, baby boomers will have to drop their asking prices.

Not all estates are equal

As an end word, we are not advising against buying real estate. Property remains a unique financial decision and its advantages and disadvantages depend heavily on the individual circumstances of each buyer. However, it is important for buyers to recognize that the real returns on housing are often overestimated and have historically underperformed compared to stocks.

We anticipate turbulence ahead for the housing market, driven by generational wealth transfers and stagflation, which may ultimately lead to some much-needed price corrections. That said, we also believe certain segments of the real estate market will continue to perform well or at least keep up with inflation. Properties in highly competitive urban areas are likely to remain in strong demand and the urbanization of society may shield them from demographic shock waves.

And you, what are your thoughts on the trajectory of the housing market?

Thank you for reading. If you like our work, feel free to support us :)