10% Yield, paid out monthly?

This little known royalty company has immense upside potential while paying your rent.

Oil and gas companies are historically cheap. They are pricing in a near-term recession and a reduction in global demand for fossile fuels. Ironically, demand for fossile fuels is at all time highs, and companies are recording record cash flows.

While producers need some of that cash to fund their growth pipelines, royalty companies can technically return all of it to investors. As royalty owners receive a fixed share of the revenue of a producing asset from the asset owner and aren’t responsible for operating costs, this means that, practically speaking, their gross is their net. Because of this superior business model, royalty stocks are traditionally expensive. But in some cases, true bargains occur. And I believe that this is currently the case with Freehold Royalties ($FRU.TSE).

Company Overview

Freehold Royalties stands as one of North America's premier energy royalty companies, managing one of the largest non-government portfolios of oil and natural gas royalties in Canada and a substantial presence in the United States. The company's business model is built around collecting royalty income from gross production revenue without bearing any of the capital costs typically associated with oil and gas development. Recently, Freehold expanded its footprint through strategic acquisitions in Texas, which are expected to contribute significantly to its 2025 production and revenue.

The company's portfolio includes royalty interests in more than 20,000 producing wells and almost 400 units spanning five provinces in Canada and eight states in the U.S., with royalty income generated from over 360 industry operators throughout North America.

Land Base and Production Profile

Freehold's land base encompasses around 6.1 million gross acres in Canada and 1.2 million gross drilling acres in the United States.

In 2024, Freehold’s production mix consisted of:

9% heavy oil

43% light and medium oil

12% natural gas liquids

36% natural gas

This oil-weighted profile of approximately 52% provides a favorable balance between liquids and natural gas exposure, and its large land ownership positions Freehold as a unique player in the North American royalty space, giving it significant scale and diversification advantages.

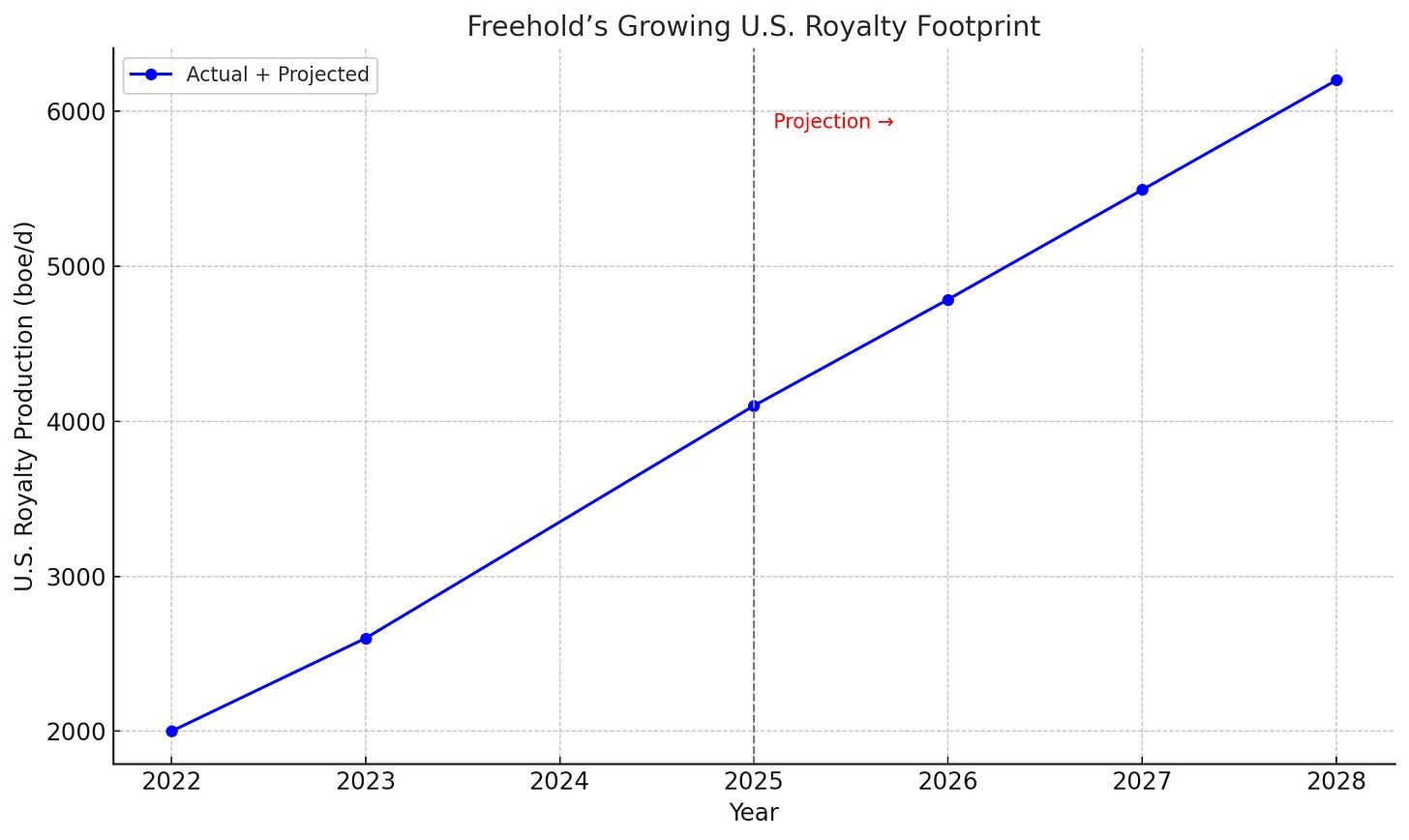

Growing U.S. Production

A significant development for Freehold Royalties is its recent Texas asset acquisition, which represents a substantial expansion of its U.S. footprint. The acquisition carries an approximate price tag of $216 million (net of adjustments) and is expected to contribute 1,500-1,600 boe/d to Freehold's 2025 production. This represents a substantial addition to the company's existing production base.

At an assumed WTI price of US$70 per barrel, these assets are projected to generate approximately $37 million in net royalty revenue in 2025. The acquisition also adds approximately 244,000 gross drilling acres to Freehold's portfolio, representing a 35% increase in its U.S. footprint. I expect Freehold to further increase its U.S. portfolio in the future:

This is especially positive because the U.S. presence helps to reduce the potential risks presented by tariffs.

The Freehold advantage

Freehold has lower output than some of its peers, but through superior financial management and the quality of its royalties, its annual revenue is competitive:

Freehold and Kimbell stand out in this comparison, and Kimbell is probably worth a second look, too. However, Freehold’s immense acreage allows for more growth and exploration potential. In my view, it therefore presents a better value proposition at present.

Note too that despite a challenging price environment in recent years, Freehold delivered a strong netback:

With Freehold trading cheaper than most peers while returning more money to shareholders, it is certainly a top candidate in the oil & gas royalty sector.

The royalty model is set to last

Not all resource companies are eager to engage with royalty companies. And it makes sense. Signing a royalty deal often means giving up a large portion of your future revenues before you've mined a single ton. Management will often seek alternative methods of financing, such as debt or shareholder dilution, before considering royalty contracts. As a result, new deals can be tough to secure for royalty companies.

So why has royalty financing grown from $2.1 billion in 2010 to more than $15 billion in 2019 (McKinsey1)? The reality is that natural resource companies are finding it increasingly challenging to get “traditionally funded.” To raise capital, they now have to compete with more players than ever in the debt market. In a world where trendy tech start-ups get all of the love from lenders and VCs, funding is drying up for more traditional and capital-heavy businesses, with natural resources topping that list. Simultaneously, the poor performance of natural resources equities during the 2010s has driven investors away from the sector, resulting in reduced equity funding and tighter debt financing.

As we speak, natural resources equities show signs of revival, with gold leading the way. Nonetheless, the sector will remain under-funded as we predict capital will become even more scarce in the next couple of years. It will take more than a bull run to restore retail and institutional investors’ confidence in the sector. On the macro front, the current instability and the looming threat of inflation/stagflation are causing lenders to be very cautious with their capital. Venture capital, while rumoured to be making “a comeback to mining,” is effectively pausing its deals.

In this environment, royalties will remain as one of the most sustainable and recession-resilient sources of funding for resource companies.

Dividend Policy

Freehold is additionally attractive because of its consistent dividend policy, which currently stands at C$0.09/share monthly. At today’s prices, this represents nearly a 10% annual yield. Investors who bought at the bottom earlier this month are getting even more. Personally, I prefer a monthly payout compared to the usual quarterly dividends. It allows you to use the money to pay rent, or to reinvest it quicker to make use of dips.

Financially, Freehold maintains a net debt-to-funds from operations ratio below 1.5x. This helps ensure the company can maintain its dividend through commodity price cycles while still pursuing strategic acquisitions to enhance its royalty portfolio.

However, it's worth noting that the payout ratio reached 109% in late 2024 and early 2025, which exceeds the company's target of approximately 60%. This elevated payout ratio deserves monitoring as it may impact the dividend level if earnings do not rebound.

The bottom line is that I expect oil and gas prices to do well over the next couple of years and that this will be reflected in Freehold’s earnings, reducing the payout ratio while potentially increasing the dividend and share price.

Thank you for reading. If you liked this post, please consider commenting and subscribing. We aim to put out frequent, high-quality content for FREE.

https://www.mckinsey.com/industries/metals-and-mining/our-insights/streaming-and-royalties-in-mining-let-the-music-play-on