The Silver Mormons Delivered

Last night, $CDE and $PAAS released their Q2 numbers, and we can't complain...

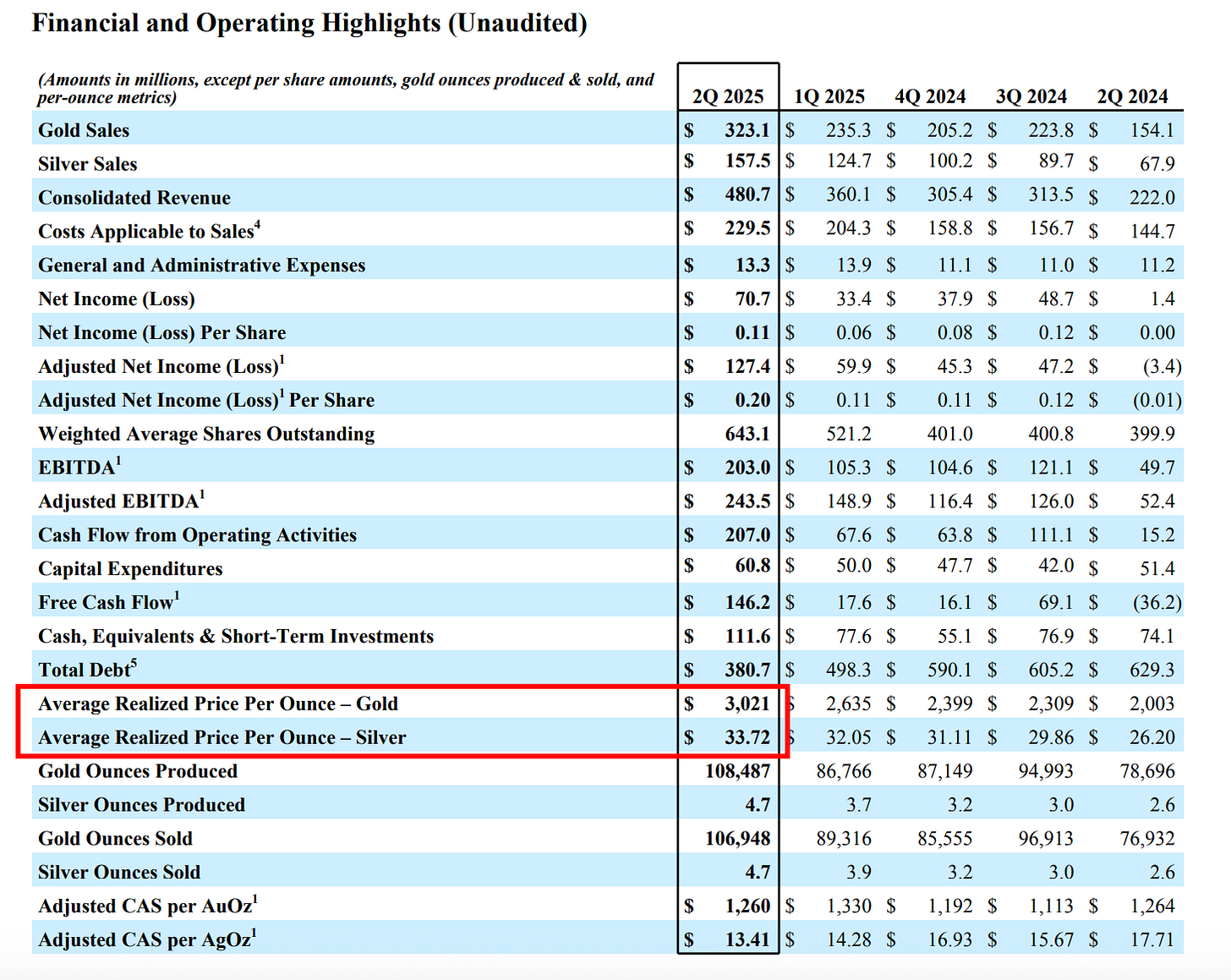

Let us start with Coeur Mining $CDE, as they published their quarterly results around an hour before Pan American. Highlights include:

Silver production of 4.7 million ounces (27% higher quarter-over-quarter)

Gold production of 108,487 ounces (up 25% quarter-over-quarter)

Record $146 million in Free Cash Flow

Repurchased 216,500 shares at an average price of $9.24 per share and repaid $110M in debt

Coeur also reaffirmed its annual guidance of 380,000-440,000 ounces of gold and 16.7-20.3 million ounces of silver.

These numbers are solid and better than expected. However, the realized prices of gold and silver could have been better:

The average gold price during Q2 was around ~$3,280 per ounce. Further, the average silver price was approximately $35.47 per ounce. According to their reports from last year, there should be no more hedges in place, so it is unclear what caused these misses of ~8% each. Nonetheless, we are happy with the FCF run rate and ounces produced.

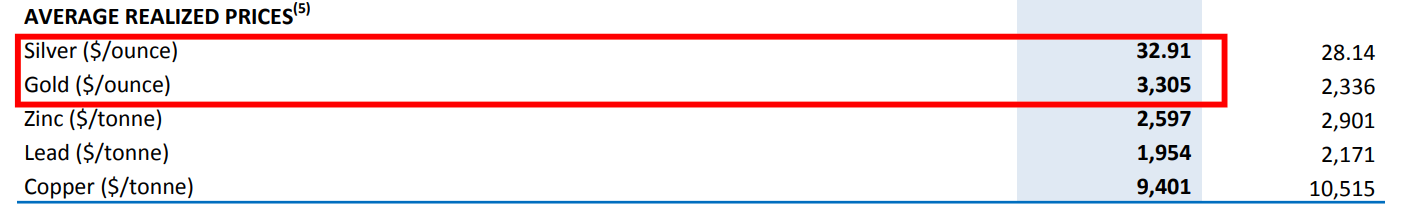

Now, for Pan American Silver, we are equally happy. Highlights include:

Silver production of 5.1 million ounces

Gold production of 178.7 thousand ounces

Record free cash flow of $233.0 million

$1,1B in cash

Their Gold AISC during the quarter was $1,611, which isn’t low, but within the usual range for the company. Silver AISC was at $19.69 per silver ounce, which is solid. Coeur doesn’t report AISC, but we estimate that Pan American’s numbers are slightly better. Their strong financial health allows them to pay a dividend of $0.12 per share later in August (20% increase). Further, the Company repurchased 459,058 shares at an average price of $24.22.

We are looking forward to the contribution of Juanicipio to their production profile. The acquisition went smoothly and should have a continued positive impact on free cash flow, which was driven by high realized prices in Q2:

We note that, like Coeur, realized silver prices weren’t perfect, but they certainly delivered in the gold sector.

Both companies continue to be among our favorite silver stocks, with Pan American being operationally stronger, and Coeur benefiting from its North American-focused production profile and a cult-like status in the sector.

Thank you for reading. We will be on the companies’ earnings call later and publish additional notes if necessary. If you enjoy our content, please consider subscribing. It’s FREE:

Until next time,

Anti-Thesis