Greenland — A compelling investment case?

Why Greenland's natural resources could provide big wins to investors in the near future.

Have you ever wondered why U.S. President Trump expressed interest in acquiring Greenland?

In 2019, President Donald Trump first mentioned this unconventional proposal. In 2025, he once again brought it up - and this time, it looks like he might try to follow through. Besides the practicality, many question the value proposition: what exactly is there to acquire in Greenland? But Trump is far from being the first politician to attempt coveting the island. Greenland has always sparked attraction, primarily because of its strategic location and symbolism, but also because of its untapped natural resources. Green-Land is, in fact, more rocky than green, and beneath its icy surface lies a hidden wealth of minerals. Specifically, it contains the rare minerals and precious metals essential to the green transition of the US and the rest of the world.

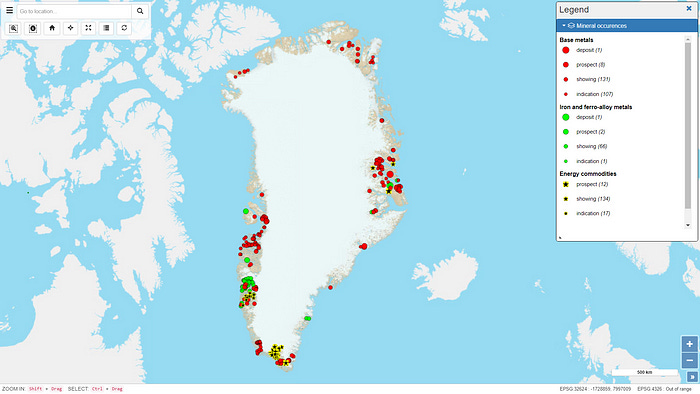

This map shows the occurrences of various commodities in Greenland. The red dots are base metals, such as copper, nickel, and zinc. Copper, which is believed to be the first metal humans discovered, is critical for the energy transition, as it is used in power generation and transmission, electronic product manufacturing, the production of industrial machinery and vehicles, as well as the creation of wiring, radiators, motors, connectors, bearings, and brakes in the automotive industry.

Nickel, on the other hand, is used in batteries, including rechargeable nickel-cadmium batteries and nickel-metal hydride batteries used in hybrid vehicles. The yellow dots are energy metals, mainly uranium. Uranium is used as fuel to heat water in nuclear power plants, and the demand for this metal is projected to exceed the supply by a large margin for the next decades, as we move towards green energy sources, where nuclear is the clear winner.

If you wonder why the commodities appear only in the coastal regions, that is because the country is largely covered by a giant glacier!

This is a photo of the Nuussuaq district in Nuuk, the capital of Greenland, with the Sermitsiaq mountain in the background. Most Greenlandic settlements look very similar to this — hugging the parts of the coast that aren’t completely covered in ice.

So it comes as no surprise that the remote island, located between the North Atlantic Ocean and the Arctic Ocean, is the least densely populated country in the world. It hosts just under 57,000 people in a space of 2.2 million square kilometres. The consequence of this has been a vast lack of infrastructure, until the Greenlandic government kicked off a plan in 2021 to change the accessibility of the country forever. Major upgrades have been undertaken to the airports of Nuuk (the capital) and Ilulissat. Additionally, the construction of a third airport in Qaqortoq officially started in 2022 and is expected to be completed in 2025, enabling new direct flights to North America. Additionally, there have been significant harbour and road developments, including a dirt road between Sisimiut and Kangerlussuaq. This is the first ever road to connect two towns in Greenland.

While this initiative is great for residents of Greenland and people looking to travel there, there is also another player who benefits from increased infrastructure and access to the country. And that is companies in the natural resource business. As mentioned above, Greenland is extremely rich in rare earth metals, precious metals, precious stones, coal, graphite, and uranium, drawing various mining companies to the country. However, it’s been rather difficult to turn mining in Greenland into a reality. Yet.

The country has historically attempted to engage in mining activities, such as mining coal in Qaarsut on the Nuussuaq Peninsula during the 1700s and the cryolite mine in Ivittuut in southern Greenland. In the 1850s, the Josva Copper Mine was put into production, however, several ship losses and the lack of a proper resource estimate led to the mine being abandoned soon. The few mines that still operated in the 20th century have been mostly shut down in recent decades, including the Seqi olivine mine near Maniitsoq, which was shut down in 2011, and the Nalunaq gold mine near Nanortalik, which was decommissioned in 2013.

Though a resurgence of mining in the country could be well on its way, as a multitude of new miners have started exploration and development activities on the island. This is because, on top of its geological attractiveness, Greenland is also in a unique geopolitical position — it is not part of the Russian area, not an African country, where it can often be difficult to get cash in and out, and not in China, which most investors prefer to stay away from due to a variety of circumstances. Politically, this makes it quite attractive, comparable to Canadian jurisdictions like British Columbia.

Historically, its isolation, severe weather, and lack of infrastructure have caused a lack of foreign investment in the mining industry since mine developers must pay for extra infrastructure to support their sites. Due to its small population and lack of mining experience, Greenland forces businesses to rely heavily on temporary foreign labor. The processing of work permits by Denmark’s Immigration Service (SIRI), the institution responsible for handling these matters, may take up to three months. On top of that, the tax rate is higher than in most other mining jurisdictions. Nonetheless, companies like Amaroq Minerals (LSE: AMRQ) have taken on this challenge and have been making sizeable progress. Amaroq has acquired the above-mentioned Nalunaq mine, as well as a significant land package covering 7,615.85 km² centered around the mine. The company is currently in the process of bringing Nalunaq back into production and announced its first gold pour in Q4 2024.

A success in reaching this goal could kick off an outburst in market enthusiasm towards Greenland, leading more investors into the sector, as well as guiding more mining companies onto the island. In this scenario, companies would have a compelling incentive to cooperate on expanding critical infrastructure, making the country more accessible by ship and plane, and improving the government’s balance sheet through their tax contributions, which could in return support the development of social programs and essential services, ultimately improving the overall quality of life for Greenland’s residents.

While this is a mere daydream as of now, the likelihood of it becoming a reality is grounded in several tangible factors. The growing global demand for minerals, coupled with increasing concerns about supply chain security, creates a conducive environment for exploring mining opportunities in Greenland, and investors could make serious gains by capitalizing on this trend early through strategically investing in companies with exposure to Greenland’s mining sector.

If you liked this post, please consider subscribing to support our work. Thank you.