Gold has a youth problem

The average gold investor is in his 50s. A generational shift is needed.

The demographics of gold investors tend to skew on one side. “Old, fat, bald, white rich guys,” as Rick Rule likes to say.

When we went to the Deutsche Goldmesse in Frankfurt two months ago, we were one of the few attendees in their 20s. Don’t get us wrong, this isn’t an ageist critique. We admire the wisdom that often comes with age. In fact, it’s likely that very wisdom that led many older investors to seek out gold in the first place.

But as much as we are bullish on the commodity, the gold industry is aging. Many of its practices and narratives are becoming a bit outdated.

Why does it matter? Wouldn’t high prices naturally attract a new generation of investors?

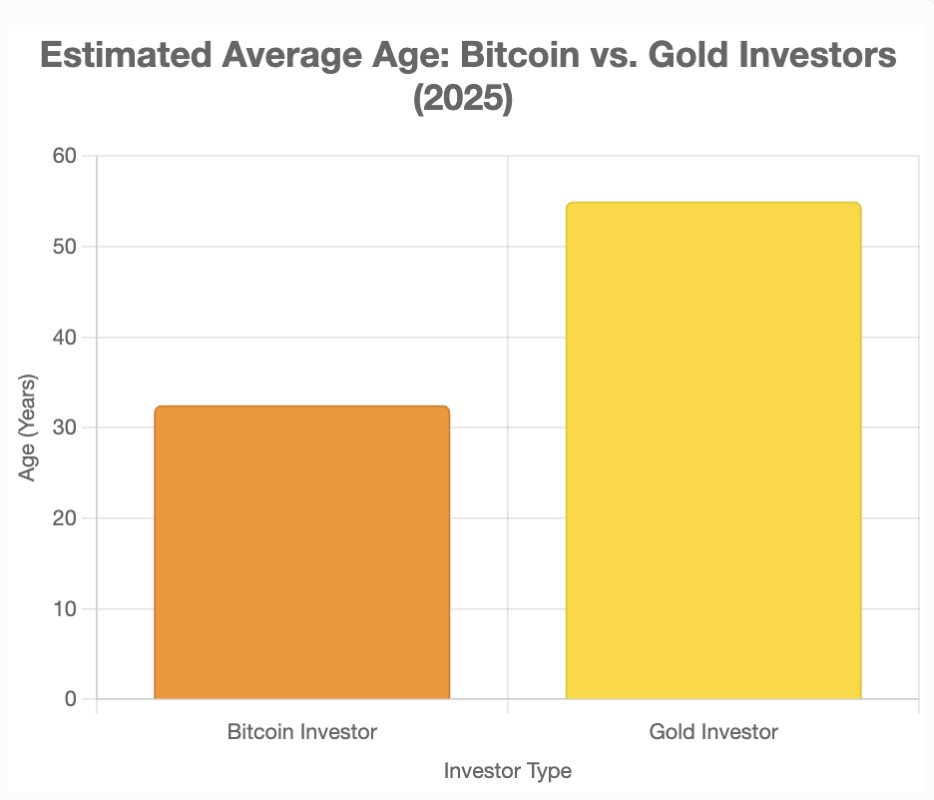

Gold has entered a bull market (up 76% since July 2023), but the generational shift is not really in sight. Gold’s returns have been attractive, but the competition for investors is fierce, against stocks, cryptocurrencies, and others. These investment vehicles often intersect with digitalization and technology, hence drawing younger crowds. As such, the average age of the gold investor is almost twice that of the bitcoin investor:

This should not prevent gold from doing well. There is enough liquidity in circulation to take it to new highs, especially if equities underperform. Plus, central banks buying, industrial use, and jewellery shall continue to become a strong source of demand. Frankly, investors need gold more than gold needs investors.

The issue at stake is more about an entire generation ignoring one of the few assets that has consistently defended wealth against inflation, volatility, and systemic failures.

It’s a generation largely unaware that one of its best chances to fight rampant inflation lies in an asset long cherished by older investors. As the U.S. government continues to devalue the dollar, younger people deserve to know that hedging solutions exist outside of volatile stocks and speculative cryptocurrencies.

This isn’t about crowning gold as the ultimate portfolio holding or positioning it as bitcoin’s rival. We believe both assets have a role to play in a long-term portfolio designed to preserve value and hedge inflation. It is about reframing gold as a contemporary asset to preserve and grow wealth.

Digital gold, despite its rough start, is a first step in the right direction. But the industry must go further:

Build a stronger narrative and culture around gold (that’s what we try to do at Anti—thesis)

Offer low-fee, user-friendly digital products and promote existing ETFs and ETCs better;

Modernize marketing practices. The new generations now get their investment advice from TikTok and Instagram, where gold is absent from the conversation.

Thank you for reading. Your support is always appreciated.