$GMIN is still cheap

Why it's not too late to get on the train

G Mining Ventures ($GMIN.TO) had a good year. It’s up 75% this year alone and more than 500% since 2023. However, I believe the stock still presents a solid value proposition with major catalysts in the near and medium term.

The company currently owns three projects: Tocantinzinho (TZ), Oko West, and Gurupi (formerly CentroGold). TZ is located in Pará State, Brazil, and has been in production since September 2024, producing 63,566 ounces at an AISC of $972 in 2024. Management believes TZ will produce 175,000-200,000 ounces this year at a slightly higher AISC.

Oko West is GMIN’s other flagship asset. Located in northwest Guyana, it strongly benefits from Guyana’s pro-mining policies and speed of permitting. The 2024 PEA attributed an after-tax NPV5% of $1.4 billion at a gold price of $1,950/oz to the project, with an average annual gold production of 353,000 ounces at an AISC of $986/oz for 12.7 years. A feasibility study (“FS”) is expected to be published in April 2025. LP Gignac’s comments during the conference call on March 28 suggest that the FS will be robust and a construction decision will follow later this year.

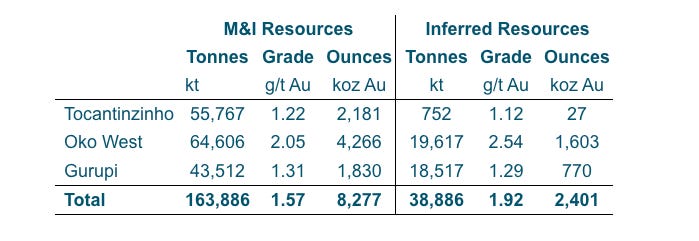

Gurupi is their earliest stage project and was “given” to them basically for free by BHP. They merely have to pay an NSR to BHP once the project is in production. Earlier this year, GMIN published an updated Mineral Resource Estimate (MRE) with 1.83 M Indicated and 0.77 M Inferred gold ounces. GMIN will spend $2 to $4 million this year on exploration efforts to advance the project.

Across the three projects, GMIN sits on 8.3 M ounces in the M&I category and 2.4M ounces Inferred as shown in their latest consolidated MRMR estimate:

If we assume that GMIN produces 180,000 ounces at TZ with an AISC of $1100 this year, at $3000 gold, this corresponds to free cash flow of $342,000,000. With a market cap of just below $3B, this means that GMIN currently trades around 9x 2025 FCF, or a FCF yield of 11%. In comparison, Barrick Gold over the last four years on average had a 4.6% FCF yield. Across the sector, in a gold bull market, producers often trade at up to 20x FCF. This means that GMIN can still double from multiple expansion alone, not taking into account the 8.47M ounces at Oko West and Gurupi. Looking at it like that, one could argue that you currently pay a low price for cash flow from TZ while getting Oko West and Gurupi for free.

Another way to look at it is price to NPV. In 2022, the NPV@5 of TZ was $622M at $1600 gold and $1.1B at $2000 gold. At $3000 gold, I expect the NPV to hover around $2B. Oko West at $2600 gold has an after-tax NPV@5 of $2.7B. At $3000 gold, the NPV exceeds $3B. This means that at current spot prices, TZ and Oko West together are worth >$5B. So GMIN trades at a P/NPV of 0.6 (at spot). Given the quality of management, the stock should trade at 1.0 P/NPV at least, considering the average for intermediate producers is 0.93.

In any case, Gurupi is currently free. I like free. And with more updates from Gurupi this year and potentially a PEA in 2026, this will allow the market to price in this asset too, which I believe will be worth more than $2B in the future. Furthermore, Oko West’s FS in April will further de-risk the project and justify a revaluation. I expected construction to commence this year, which means we could see first gold production already in 2026. By 2027, I expect GMIN to produce 500k ounces annually. By then, gold is probably closer to $4000; however, at $3000 gold and $1100 AISC across both assets, that’s almost $1B in free cash flow. At 20x FCF, this would justify a $20B market cap in 2027, or a 7 bagger from here (assuming no dilution).

In my opinion, the stock will be worth $10B (or around CAD $60) in 2026, and CAD $100 per share in 2027. Hence at the current price of CAD $19, it is still cheap.

Thank you for reading!