A quick look at Paladin's latest report

Why this oversold and over-shorted stock has 3-bagger potential

On 23/04/2025, Paladin Energy ($PDN) posted its FY25 Q3 activities and cash flow reports. In Australia, the stock is currently up 26% in response, which makes it down only 23% for the trailing month.

Here are the most important takeaways:

Paladin produced 745,484lb U3O8 at Langer Heinrich Mine (which they own 75% of), a 17% increase from the previous quarter

They sold 872,435lb at an average sales price of $69.9 per pound and a production cost of $40.6

Its offtake contract book now includes 12 contracts with “tier-one global customers,” with 22.3 Mlb U3O8 contracted to 2030.

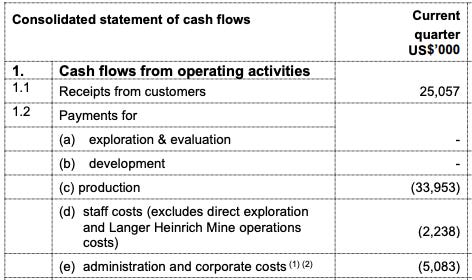

Operational cash flows for the quarter were negative at -$17.7M, but they recorded $24M in net cash flows from investments (mainly “proceeds from the disposal of investments related to the maturation of short-term investments” aka T-bills that matured)

The $69.9/lb sales price is higher than spot, but lower than Cameco’s recorded LT price, which consolidated around $80 YTD.

They made $19M selling uranium: 872klb * ($69.9 - $40.6) * 75%; however, they still lost money:

Assumably, this loss is due to payments related to the one-in-fifty-year rainfall event?

If they keep up these production levels without incurring further losses from dramatic events, they will make $80m/yr at LHM. After today’s stock surge, the market cap is now at $1.29 B. That would put them at a 16 FCF multiple.

However, Paladin wholly owns the Patterson Lake South Project (PLS), which has an After-Tax NPV@8 of $1.204 B at $65/lb. At the current realised sales prices, we can assume that the PLS project makes up the entire market cap of Paladin. Notably, the market cap is currently lower than Fission’s market cap before the acquisition. Therefore, its stake in LHM, as well as its Michelin project in Canada and its exploration properties in Australia, are entirely free.

The Michelin project is a tier-1 asset in the making, and Paladin sees opportunities to share resources between its PLS and Michelin projects. PLS helps fill the gap in the timeline between LHM and Michelin.

Given this combination of producing assets and high-tier development projects, the stock looks pretty undervalued. Being the second most shorted stock on the ASX hasn’t helped its performance recently. Over the next months, I expect this to change, as trust in the sector is restored and the market assigns fair value to LHM and Michelin. That should put the stock at $3.5 to $4 B.

Along with Cameco, Paladin currently presents one of the best opportunities in the space, in my opinion.

Thank you for reading. If you enjoyed this post, please interact. It is FREE.