A Quick Look At Coeur Mining's Q1 Report

Coeur is the US' largest silver producer. It's been a dog, but is it finally delivering?

Coeur Mining ($CDE) posted its first 2025 Quarterly today. Here are the key takeaways:

Coeur produced 86k ounces of gold at $1650 AISC with an average realized gold price of $2,635

and 3.7M ounces of silver at $21 ASIC at a realized price of $32.05

resulting in $33M net income

they now have $78M in cash and $468M in debt

and they expect the next quarters to be stronger than Q1

Coeur had a good quarter. Debt paydowns suppressed free cash flow, which is okay. They need to fix their balance sheet. The balance sheet is (still) ugly, but it’s now better than Hecla’s, which is one of their main competitors for go-to silver stocks. Hecla dropped 20% this week after releasing pretty bad earnings.

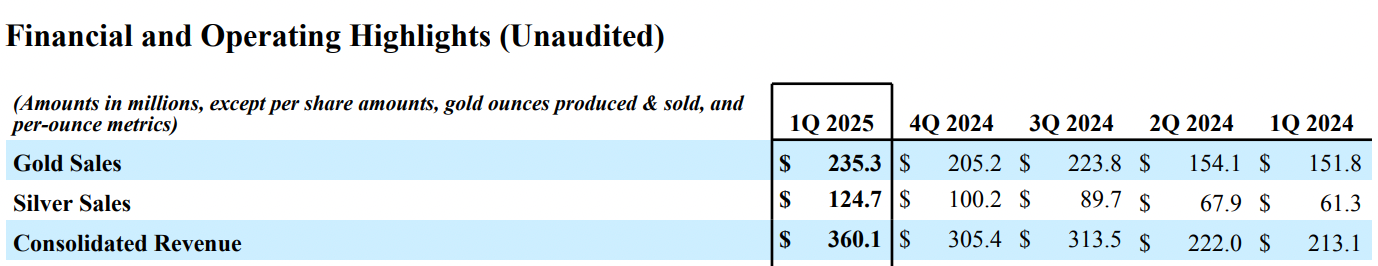

Back to Coeur, compared to previous quarters, revenue is up nicely:

With gold at all-time highs and silver at multi-year highs, this is expected, but still good to see. Their AISC margins on gold are now around $1000. This will get even better when hedges expire and gold remains elevated. AISC margins on silver are $10, which is also good. These numbers are at the higher end of the industry, but with most of their operations in the US, that is reasonable.

At $40 silver, the AISC margin doubles, and at $50 silver, it triples. This makes them very leveraged to higher silver prices, which we expect, both in the near and medium term.

We would also like to point out that their G&A expenses seem to be well managed:

For a company of this size and status, this number is okay. Many companies start to raise G&A as soon as they earn a little bit more money. In the case of Coeur, G&A is actually down YoY ($14.4M in 24Q1 vs. $13.9M this quarter). Considering the weakening dollar over this period, this is especially nice to see.

Las Chispas

This is the first quarter that includes production and revenue from Las Chispas (Mexico), which they now operate as they acquired SilverCrest last year. FCF from Las Chispas totaled $92 million, which includes the sale of held bullion and finished goods (totaling $72 million). This is after operating the mine for only roughly 1.5 months. They expect Las Chispas to produce 42,500 - 52,500 ounces of gold and 4.25 - 5.25 million ounces of silver this year. Those numbers are decent and realistic. They also announced some high-grade discoveries at the project, which could hint at higher output in the future.

Wharf

Their South Dakota mine, Wharf, is another core asset. Gold production in the first quarter decreased 7% QoQ to 20,491 ounces. According to the company, this is largely due to the timing of ounces placed on the leach pad in the prior quarter. Full-year 2025 production is expected to be 90,000 - 100,000 gold ounces and 50,000 - 200,000 ounces of silver. Production at Wharf should be monitored, and we want to see at least 25koz AU next quarter. Further, we see synergy with Dakota Gold’s Richmond Hill project and would like Coeur to explore potential opportunities.

This is the total production guidance for each project:

This is looking pretty good. As a 400koz gold producer and the largest US silver producer, the stock is pretty cheap at a $3.5B market cap. With their current margins, they’ll be making around $500-600M in FCF this year, putting them at a 6-7x multiple. Once silver breaks above $35, this stock is off to the races.

Conclusion

The earnings call is later today, and we’ll make updates to this post if necessary. However, this was a good quarter for Coeur, and we continue to be bullish on the company. We expect the production profile to improve as Coeur gains more experience operating Las Chispas and Wharf’s output picks back up.

This is a top pick for silver stocks with multi-bagger upside at increasing silver prices.

Thank you for reading this post. We try to publish timely updates for the stocks we follow, and to continuously increase this number. If you support this goal and like our work, please subscribe. It’s FREE:

If you would like to further contribute to our mission, you can do so here:

thanks for the update, it's more a gold play than a silver play with 2/3rd revenue from Au. The silver margin doesn't double when silver goes to $40 due to royalties/taxes, etc. It certainly goes up, but not as much you think. But thanks to Coeur, I got a great deal when they bought Palmarejo out at a top price. The real money in silver is made in the explorers, selling to the majors, not buying the majors.